Tariff War Global stock markets witnessed a sharp decline following President Trump’s announcement of broad tariffs. In response, Beijing launched retaliatory measures, heightening fears of a full-scale global trade war. Financial markets across Asia—including India, Japan, China, and Australia—suffered significant losses, wiping out over $9 trillion in market value.

Tariff War Impact: New Delhi:

Tariff War Impact: Global markets saw a sharp downturn on Monday following U.S. President Donald Trump’s announcement of sweeping tariffs and Beijing’s retaliatory decision to impose a 34% duty on all U.S. imports starting April 10. Fears of an escalating global trade war shook investor confidence, leading to steep declines across Asian stock markets. According to analysts, more than $9 trillion in market value has been wiped out in just two days—drawing stark comparisons to the 2008 financial crisis. After Friday’s significant slump, Wall Street is bracing for further losses. The S&P 500 fell by 6%, the Dow Jones dropped 5.5%, and the Nasdaq declined 5.8%, marking their worst single-day performances since the onset of the pandemic.

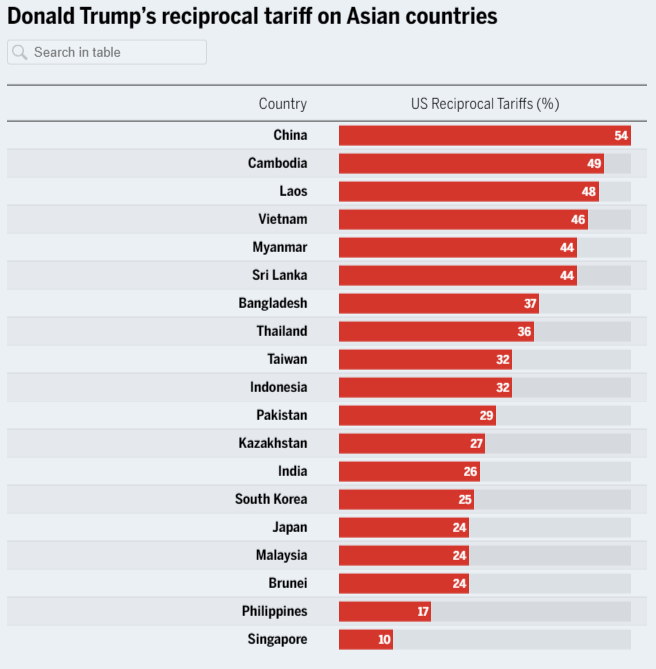

Donald Trump’s retaliatory tariffs on Asian countries

Meanwhile, senior officials under President Trump revealed that, amid the turmoil in global markets caused by the hike in import tariffs, more than 50 countries have reached out to the White House to initiate talks on tariffs. Treasury Secretary Scott Bessent warned that resolving unfair trade practices will not be a quick process and is likely to take considerable time.

India: Bloodbath Amid Global Turmoil

Tariff War Impact: Indian equity benchmark indices, the BSE Sensex and Nifty 50, plunged over 3.5% on Monday as rising global trade tensions and external headwinds rattled investor sentiment. Both indices witnessed a sharp intraday fall of nearly 5% before a partial recovery. By the end of the session, the Sensex had declined 2,227 points or 2.95% to close at 73,137.90, while the Nifty 50 ended 743 points lower, down 3.24%, at 22,161.60.

Top laggards on the Sensex included Tata Steel (-7.78%), L&T (-5.88%), Tata Motors (-5.56%), Kotak Mahindra Bank (-4.42%), and M&M (-4.06%). All 13 sectoral indices ended in the red, with technology stocks—heavily influenced by the U.S. market—shedding as much as 7%.

The broader market also saw steep declines, with small-cap and mid-cap stocks falling by 6.2% and 4.6%, respectively.

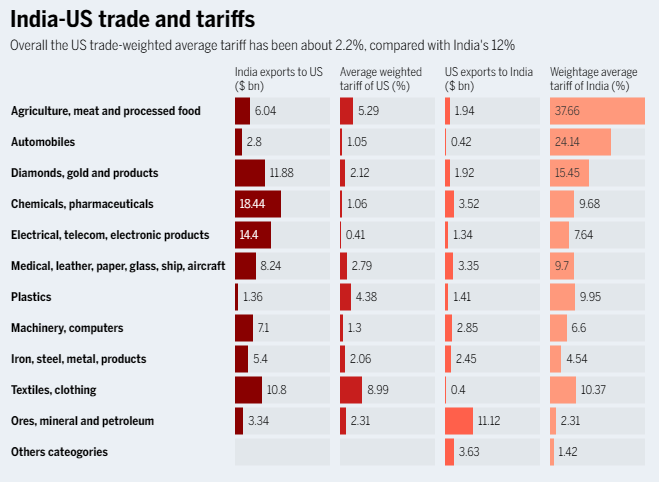

Tariff War Impact: India-US trade and tariffs

The recent market downturn is largely attributed to growing fears of a global trade war, intensified by the United States’ new tariff measures and weakening global cues. Amid this volatility, a senior official from the Ministry of Finance told Reuters that India is on track to achieve its GDP growth target of 6.3% to 6.8% for the fiscal year 2026, provided crude oil prices remain below $70 per barrel.

South Korea: KOSPI Falls 5.5% Amid Decline in the Tech Sector

Tariff War Impact: Seoul’s KOSPI dropped 5.5%, driven by declines in tech and manufacturing stocks. South Korea, which heavily relies on exports to the U.S. and China, is facing dual challenges.

Taiwan’s decision to ban short selling offered a glimmer of hope for market stability, but regional sell-offs continued.

Kevin Hassett, head of the U.S. National Economic Council, claimed, “More than 50 countries have reached out to the President to initiate talks.”

Japan: Nikkei 225 Falls 7.1%

Tariff War Impact: Tokyo’s stock market dropped 7.1%, with intraday losses reaching as much as 8%. Investors shifted toward safe-haven assets, pushing the yen to 145.98 against the dollar.

For the first time since April 2021, U.S. crude oil prices fell below $60 per barrel, highlighting growing concerns over global demand.

Unfazed by the chaos, Donald Trump remarked, “Sometimes you have to take medicine to fix something.”

China: Tariff Retaliation Deepens Crisis

Tariff War Impact: Beijing responded with a 34% tariff on all U.S. imports starting April 10, triggering a 6.5% drop in the Shanghai Composite Index.

China’s Ministry of Commerce described the measure as a direct response to U.S. “aggression,” intensifying concerns over a prolonged trade standoff.

Federal Reserve Chair Jerome Powell cautioned, “The trade war risks fueling higher inflation while dampening economic growth.”

United States: Wall Street braces for more bloodbath

Tariff War Impact: After Friday’s historic plunge—S&P 500 down 6%, Dow Jones falling 5.5%, and Nasdaq sliding 5.8%—U.S. futures signaled additional losses ahead.

President Trump doubled down, declaring, “THIS IS A GREAT TIME TO GET RICH.” In contrast, Federal Reserve Chair Jerome Powell struck a more measured tone, stating, “Our responsibility is to ensure long-term inflation expectations remain firmly anchored.” GE Healthcare and DuPont saw double-digit losses amid fears of a regulatory clampdown from Beijing.

Taiwan: Index Plunges Nearly 10%, Short Selling Restricted

Tariff War Impact: Taipei’s Taiex Index tumbled 9.8% as markets reopened following a holiday. In response, regulators imposed temporary restrictions on short selling until Friday to stem further losses.

President Lai Ching-te stated that Taiwan would not pursue retaliatory tariffs but instead seeks to negotiate a zero-tariff agreement with Washington. To cushion the domestic impact, a $2.7 billion stimulus package was announced.

Australia: ASX Hits 15-Month Low

Tariff War Impact: Australia’s ASX 200 plummeted 6.3%, hitting its lowest level in nearly 15 months. Prime Minister Anthony Albanese remarked, “You can’t change global events. What you can do is prepare for them.”

The U.S. imposed a 10% tariff on Australian goods, further heightening fears of a potential recession.urther heightening fears of a potential recession.

Singapore: Markets Tank 8.5% at Open

Tariff War Impact: Singapore: Markets Tank 8.5% at Open

Singapore’s Straits Times Index plunged 8.5% at the opening bell, marking one of the steepest declines in the region. The city-state’s strong dependence on global trade has left it particularly exposed to the escalating tariff war.

South Korea: KOSPI Plunges, Trading Halt Triggered

South Korea’s benchmark KOSPI index tumbled 5.26%, or 129.57 points, closing at 2,335.85. The sharp fall triggered a “sidecar” mechanism, briefly halting some trading activities for the first time in eight months.

“South Korea has an extremely high trade dependency—it’s a country that lives off trade. So when the U.S. imposes tariffs at such extreme levels, we become one of the hardest-hit economies,” said Kim Dae-jong of Sejong University in Seoul, speaking to AFP.

United Kingdom: FTSE Poised for Sharp Losses

UK markets were closed at the time of reporting but are expected to open significantly lower. In an op-ed, Prime Minister Keir Starmer stated, “The world as we knew it has gone,” emphasizing the need for renewed focus on “deals and alliances” in a rapidly changing global landscape.

Saudi Arabia and Gulf: Historic Slump as Oil Giants Tumble

Saudi markets nosedived 6.78% on Sunday, marking their worst performance since the pandemic era. Shares of oil giant Aramco fell 6.2%, wiping out over $133 billion in market value.

Gulf neighbors also suffered steep losses—Kuwait declined 5.7%, Qatar 4.2%, and Oman 2.6%.

“Trump’s tariffs weighed heavily on global markets, and particularly today on Saudi markets,” reported state-run Al-Ekhbariya.

What Lies Ahead: Interest Rate Dilemma, Inflation Fears

With global economic uncertainty deepening, central banks are under mounting pressure to respond. However, Federal Reserve Chair Jerome Powell signaled a cautious approach, stating, “A one-time increase in the price level must not become a persistent inflation problem.”

The Fed now faces a difficult balancing act—whether to cut interest rates to ease economic pain or hold steady to prevent inflation from spiraling out of control.

As panic continues to ripple through global markets, investor sentiment increasingly depends on whether diplomacy can replace confrontation. As President Trump bluntly put it, “They’re dying to make a deal.”